Any debit or credit transaction that affects the balance of your DROP account should appear as a line item in your account, together with the date of the transaction and the resulting account balance.

Examples of the transactions that debit (decrease) the balance of your account would be:

Examples of the transactions that credit (increase) the balance of your account would be:

Most likely you are enrolled in DROP and are still employed with your CPERS member employer. Interest is not credited until you actually terminate employment and retire. Once retired, your interest will be credited and posted retroactively back to the commencement of your DROP participation.

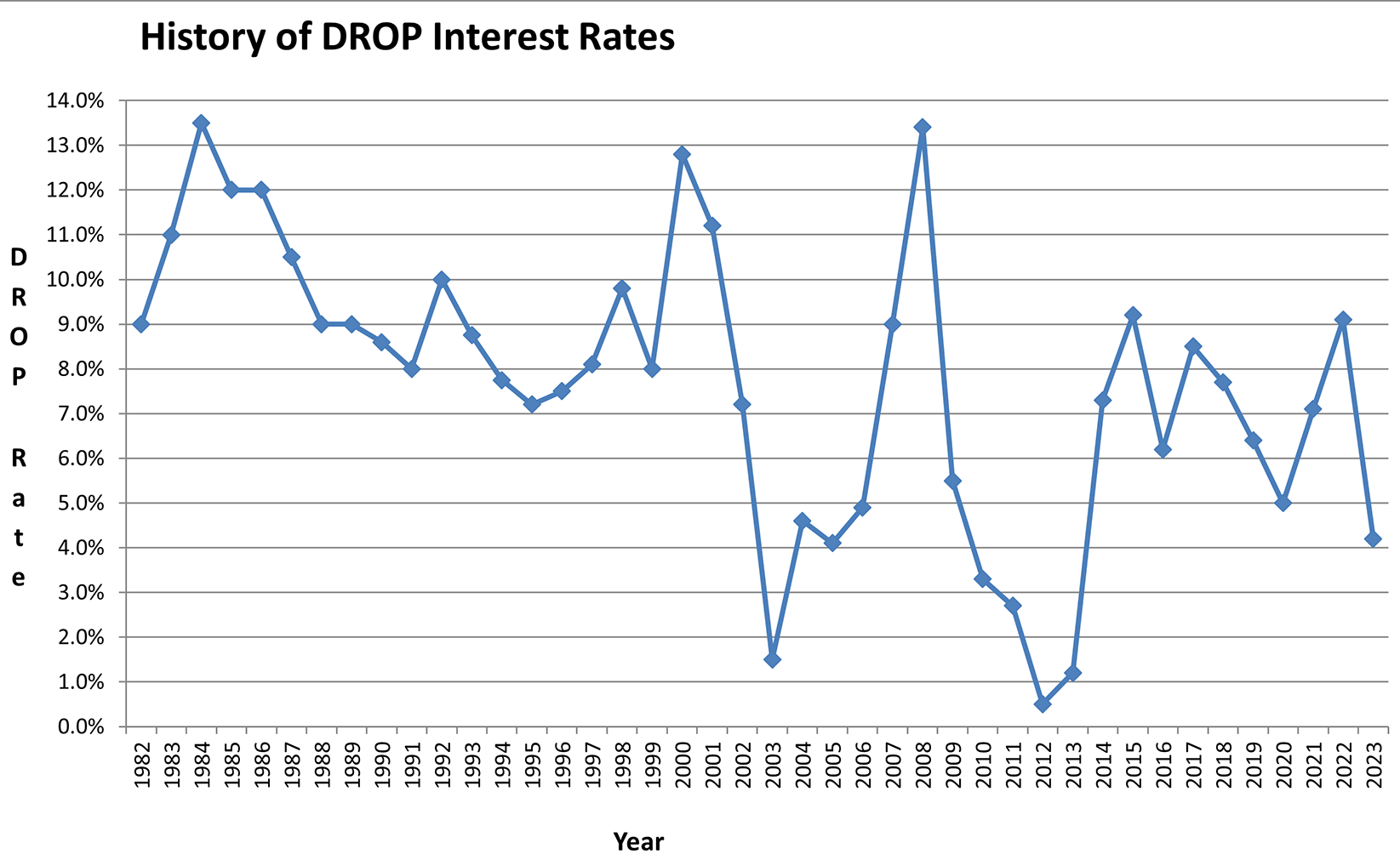

For calendar year 2024, the DROP interest rate has been certified by CPERS' actuary to be 4.2% (yield).

The DROP interest rate is certified each year by the Retirement System’s actuary, based on the geometric average of the most recent five years of investment returns for fiscal years ending September 30th. Each year a new investment rate of return enters the five year average, and the oldest rate drops out.

Yes, the DROP interest is compounded monthly to yield the actuarially computed rate.

Your DROP account deposits and credited interest will not be reduced in the event of a negative DROP interest rate, but will be treated as if the interest rate were zero in that calendar year.

To request a withdrawal or rollover of DROP account funds, please contact CPERS at (225) 389-3272 and you will be directed to a staff member who can help you.